The SBI Shinsei Bank supports the recommendations of the TCFD (Task Force on Climate-related Financial Disclosures). In line with the TCFD framework, we explain here our initiatives for climate change.

We recognize that responding to climate change is essential for the realization of a sustainable society. Therefore, we designated "response to environmental issues such as climate change" as one of our material sustainability issues. We are striving to create social value through a variety of initiatives, including investment and lending for businesses that are responding to climate change as well as to improve the Group’s corporate value over the medium to long term.

Our banking group has continuously implemented climate related initiatives across its group companies by integrating climate related financing into core business operations. We have developed a diverse range of financing options, including loans for renewable energy assets and green building projects for corporate customers and solar panel installations for individual customers.We will continue to promote climate action through financing.

In addition, to further strengthen our climate related initiatives through our business operations, we have undertaken the following initiatives. Considering both domestic and international developments related to climate change and sustainability, we will continue to advance climate related initiatives through our business activities.

Funding Initiatives

- Utilization of the funding supply operations implemented by the Bank of Japan’s funding to support climate related initiatives.

Climate-related investment and financing FY2024 result: 624.2 billion JPY (on a non-consolidated basis, based on origination amount). - Offer sustainability deposits for individual customers.

Capital Provision Initiatives

- Continuous implementation of green assessment projects by our bank (including projects for funds structured by Showa Leasing.)

- Registered with the Ministry of the Environment’s Green Finance Supporters Program as a financial institution with green finance structuring capabilities.

- Utilization of the Ministry of Economy, Trade and Industry’s performance based interest subsidy scheme for transition finance.

- Revision of our banking group’s Green Finance Framework as a capital provider.

In parallel with the execution of financing related to transitions, we continue activities through an interdepartmental "Transition Task Force" involving members from the sales department, credit department, sustainability department, etc.

One of the objectives of this task force is to gather the information necessary to have productive dialogues (engagements) with customers and to share it with the sales teams. In FY2024, the task force conducted research on the business structures of transition sectors, the technologies essential for decarbonization, and insights into innovation. The findings have been shared with sales teams through study sessions and by providing access to analytical tools.

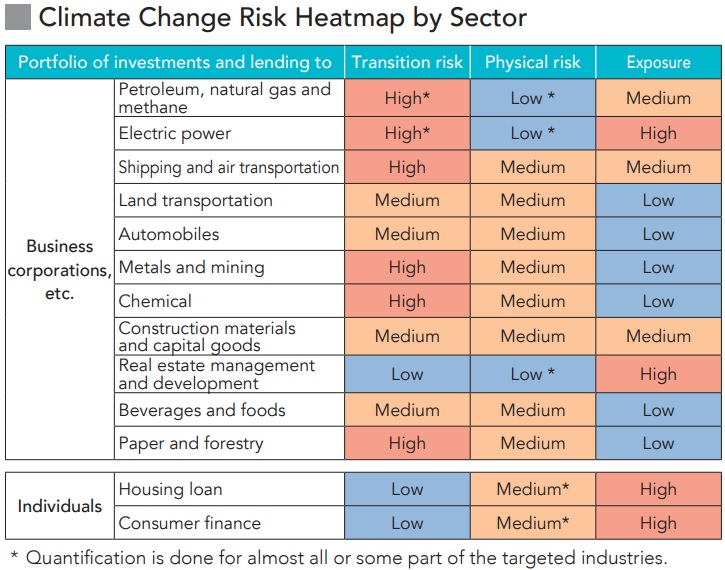

Climate change risks are mainly classified into physical and transition risks:

Physical risks:

Risks of disasters, etc. caused by climate change. The direct impact of property damage caused by weather events such as floods and storms and the indirect impact from global supply chain disruptions and resource depletion.

Transition risks:

Business and financial risks for companies from transitioning to a decarbonized society.

Carbon-related asset exposure (carbon-related assets in total exposure (energy and utilities, excluding solar and wind power project finance)) accounted for 4.2% in March 2020, 3.7% in March 2021, and 4.4% in March 2022.

We qualitatively assessed climate change risks in sectors that are likely to be affected by climate change. Based on the results of qualitative assessments and the size of exposure, the Group prioritizes each sector and asset type, and delves deeply into the risks through quantitative analysis and other methods.

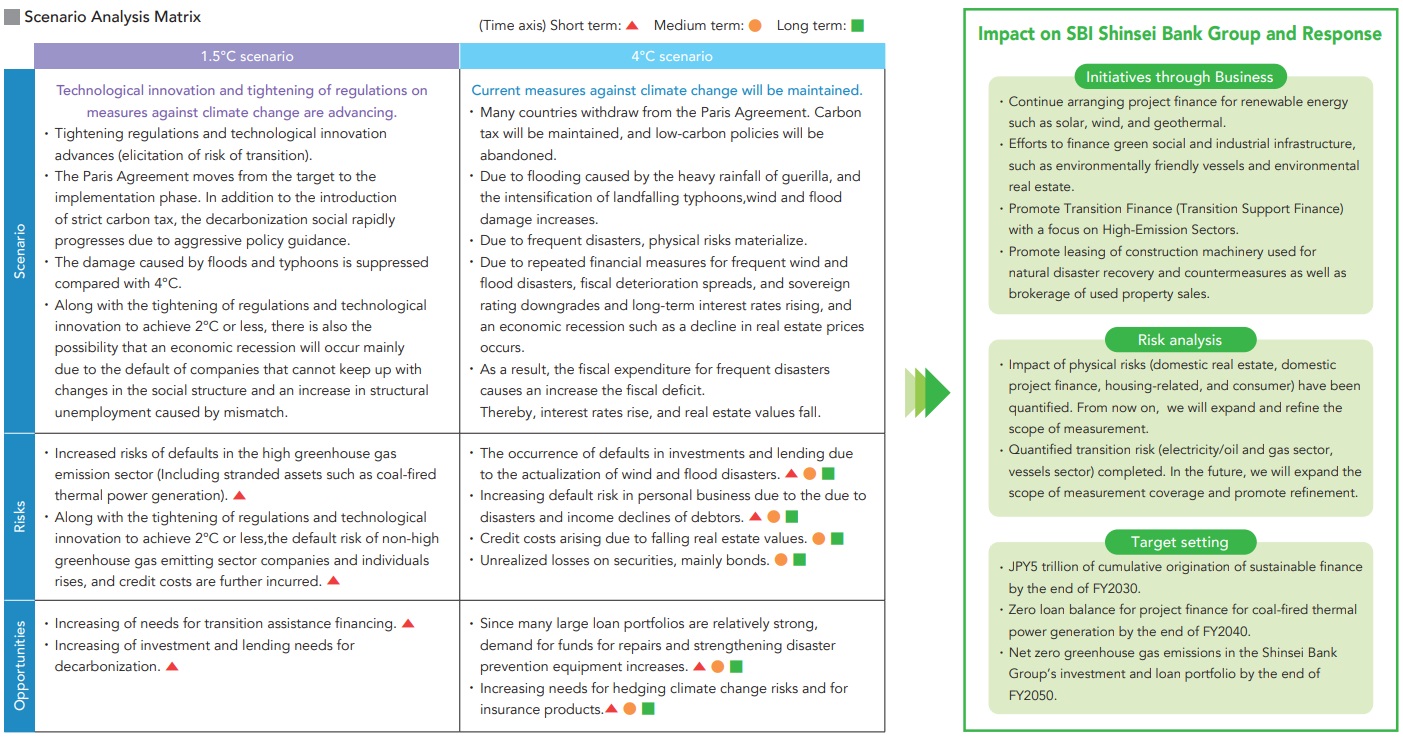

We have positioned the response to climate change as an important management issue and have organized our worldview, opportunities, and risk scenarios based on economic fluctuations and two-dimensional scenarios that we are monitoring daily (please refer to the following table, Scenario Analysis Matrix). In response to the fact that the world is heading toward a scenario of 2°C or less, we have summarized the state of the Group’s responses.

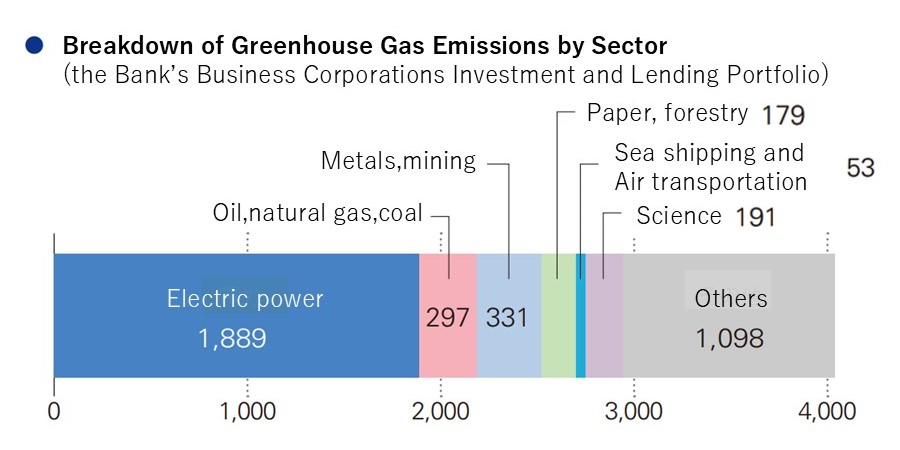

To identify the investment and lending sectors that will significantly impact the Group for climate change risks, we conduct a risk assessment for each sector— described in the Risk Heatmap, above—and consider the level of importance from the portfolio composition of the Group’s investment and lending. Sectors with high physical risks are focused on real estate (including for individuals), and sectors with high transition risks are focused on electric power utilities, shipping, and the oil and gas industry. For each of these sectors, our policy is to disclose the results of the quantification of physical and transition risks.

Physical risk is quantified as domestic real estate nonrecourse loans, mortgage loans, domestic project finance, and personal unsecured loans from Shinsei Financial. Estimating the impact of physical risks, cumulative credit-related costs through fiscal 2050 are projected cumulatively in the range from ¥5.5 billion to ¥9 billion. Although it is not necessary to take immediate countermeasures at this point, we will continue to monitor and look into expanding the scope of quantification.

For transition risk, we quantified the impact of the shipping sector in addition to electric power utilities and the oil and gas industry, and estimated that there were ¥6.5 billion to ¥28 billion of cumulative credit related costs through fiscal 2050. For the transition to a decarbonized society, we will strengthen engagement with business partners and strengthen our risk management system. We will continue to examine expanding the scope of quantification and proactively engage in investment and lending to projects and businesses that contribute to resolving issues for the transition to a decarbonized society.

In July 2021, the Group established the Responsible Investment and Lending Policy with the aim of upgrading the system for promoting responsible investment and lending. Transactions with partner companies that do not fully consider environmental and social issues is seen as a management risk, and we prohibit or restrict transactions based on the recognition that there are serious risks to the environment and society when investing and lending for certain types of projects.

From the perspective of responding to climate change, based on a precautionary approach, we do not make new investments for the construction of new coal-fired thermal power plants and we are reducing the amount of investment and lending for existing coal-fired thermal power plants.

For creating a positive social impact, the Group is strongly aware of the role of encouraging customers to consider the environment and society as a provider of funds. In April 2020, we adopted the Equator Principles in the belief that this is essential for strengthening the management system for environmental and social risks in project finance and other areas. When lending for projects that involve largescale developments, we review the impact of these projects on the environment and society and make comprehensive decisions based on the Equatorial Principles, in this way fulfilling our social responsibility and enhancing our management of environmental and social risks.

The Group recognizes the importance of financial institutions’ initiatives to address climate change risks in the shipping industry. Reducing GHG emissions is an unavoidable issue for the shipping industry. We understand that it will become more crucial to be aware of the Poseidon Principles and to respond to them in climate change risk for vessel financing.

In March 2021, we signed the Poseidon Principles as the fourth financial institution to do this in Asia. In committing to the Poseidon Principles, as a financial institution that proactively engages in vessel financing, we will provide financial support for transitions to customers and the overall shipping industry as well as manage the climate change risks associated with our businesses.

From now on, we will continue to renew our lending portfolio by strengthening our financing for vessels equipped the latest technologies, such as new/young and dual-fuel vessels. In addition to our customers, we will continue to strengthen our network with stakeholders who support the shipping industry, creating a virtuous circle that seizes opportunities for environmentally friendly vessels and green/transition finance.

In November 2022, the Group announced support for the GX League Basic Concept, a carbon neutral initiative led by the Ministry of Economy, Trade and Industry, and in April 2023 we participated in the GX League. As part of the Group’s initiative to reduce our own GHG emissions, we switched to renewable energy last fiscal year at the Nihonbashi head office and Shinkawa office in Tokyo. In addition, we will continue to work using dialogues to help reduce GHG emissions in the investment and lending sectors.

Investment and lending for renewable energy is an area where the Group has been strong, and we believe it is an important role of financial institutions to provide funds to customers who are working to help resolve environmental and social issues.

|

・JPY 5 trillion of cumulative origination of sustainable finance by the end of FY2030 |

|

・Supporting the transition promotion of corporate customers in high GHG emission sectors |

|

・Net zero GHG from the Group’s energy use by the end of FY2030 |

|

・Zero loan balance for project finance for coal-fired thermal power generation by the end of FY2040 |

|

・Net zero GHG emissions in the Group’s investment and lending portfolio by the end of FY2050 |

We measure GHG emissions of SBI Shinsei Bank and its group companies, focusing on electricity, which has the largest contribution between Scope 1 and 2.

Please see the "Environment" section of the ESG data link below for emissions for fiscal 2024.

https://corp.sbishinseibank.co.jp/en/sustainability/data/esg.html

The GHG emissions performance of our investment and lending portfolio is calculated in accordance with the international standards published by PCAF.

|

Asset type |

Balance to be calculated (billion yen) |

GHG Emissions (ktCO2e) |

Carbon Intensity |

Data Quality Score |

|

Business Corporations |

2,664 |

4,039 |

1.52(ktCO2e/billion yen) |

2.14 |

|

Project Finance |

390 |

1,590 |

0.57(ktCO2e/MWh) |

2.98 |

|

Real Estate Non-recourse Loans |

906 |

145 |

0.09(ktCO2e/1000m2) |

4.00 |

|

Housing Loans |

1,221 |

89 |

1.42(ktCO2e/dwelling) |

4.19 |

- Greenhouse gas (GHG) emissions are calculated using the international standards published by PCAF. For details see PCAF The Global GHG Accounting & Reporting Standard for the Financial Industry. https://carbonaccountingfinancials.com/files/downloads/PCAF-Global-GHG-Standard.pdf

- Data quality scores: Accuracy is scored on 5-level scale for each measurement/estimating approach for GHG emissions of investment and lending. The smaller the value, the higher the accuracy.

- These GHG emissions are calculated as the contribution of the Group to the total GHG emissions of each investment and lending.

- The Bank became a member of the PCAF (Partnership for Carbon Accounting Financials) in October 2022 and is working to upgrade the assessment of GHG emissions from investment and lending through PCAF’s GHG gas transparency protocols (aggregation method).

- Of the six asset types in the PCAF standards, we measured GHG emissions of the investment and lending portfolio based on the calculation methods from "listed stocks and corporate bonds" and "business loans and unlisted stocks" for the Bank’s business corporations, as well as "residential real estate" for housing loans, "project finance" for project finance, and "commercial real estate" for real estate non-recourse loans.